Saving regularly is a habit that needs to be cultivated and as with most things in life, starting sooner rather than later often gives investors a huge advantage.

When it comes to the topic of spending and saving, it seems like there are countless ways of doing it.

A quick internet search throws up guidelines around how much of your income you can spend and how much you should save. Some articles focus on a percentage rule – with the most common being the 50/30/20 breakdown where 50% goes towards essential living expenses such as rent and utility bills, 30% towards your everyday expenses such as entertainment, eating out and clothing, and then allocating the remainder 20% to your savings. And then there are other guidelines which adjust those percentages according to your age – suggesting that you should save between 25-35% of your income if you begin your savings journey in your early 40s.

But many of these articles gloss over one very important point – and that is, knowing how much to save is important but how regularly you save is equally so, if not more. Learning to save and doing it regularly is not something that everyone does naturally, especially if you’ve just started working and you feel like there isn’t much left to save after all the essentials have been accounted for.

But saving regularly is a habit that needs to be cultivated and as with most things in life, starting sooner rather than later often gives you a huge advantage, assuming this is a habit that you stick to through your working life.

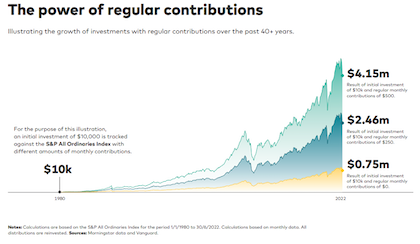

If you’re not yet convinced, the illustration below might perhaps change your mind and push you a little closer to building a habit that could set you up for life.

The chart shows that investing $10,000 in 1980 in a broadly diversified fund and leaving it untouched for the next 40 years would have delivered approximately $800,000 at the end of the four decades, thanks to the tried and true investment principle of staying the course.

However, the chart also shows that regularly contributing $250 or $500 every month to that initial $10,000 would have resulted in a portfolio balance of $2.7 million or $4.5 million respectively. While the chart does not take into account the cost of fees and assumes that all dividends are reinvested, it really paints a picture of how regular contributions could make a significant difference to your overall goals.

If you’ve just started on your savings journey, putting in place a set-and-forget system such as an automatic transfer to your savings or investment account each payday could be useful. That way, you don’t have to make any decisions about saving more or spending more each month. For those wanting to take less of a hit to your take home pay, consider contributing your pre-tax pay to your super fund (noting that you won’t be able to draw on those savings until you retire, aside from exceptional circumstances).

Finally, it is important to note that saving is different to investing, particularly if you have a short-term savings goal. If you are saving for a goal that has a time horizon of less than five years, be highly aware of the risks that you are taking on if you decide to invest those savings into the financial markets. But if you have a goal of more than five years, then consider the potential benefits that regular investing in a broadly diversified portfolio could deliver, because time is on your side.

Call us today on (02) 9299 8487 if you’d like to start your savings or investment journey.

Source: Vanguard

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2022 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.